India's Top 500 Companies 2016 |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The year 2014-15 was positive for the Indian economy with India’s real GVA growing at 7.1%, compared to 6.6% in FY14. The growth was mainly due to strong policy measures and a favourable external environment. The year 2015-16, which was expected to be more robust comes against the background of an unusually volatile external environment with significant risks of weaker global activity and non-trivial risks of extreme events such as natural disaster or terrorism. Slowdown in the Chinese economy coupled with substantial decline in global prices of crude oil and metals had a significant impact on all economies. During FY16, the Indian capital markets exhibited signs of moderation on fears of faltering global recovery. Amidst this scenario, India still stands out as a region of economic stability and an outpost of opportunities. Despite these positive indicators for FY15 and FY16, India’s leading corporates faced and continue to face severe stress on their earnings and profitability.

Dun & Bradstreet has identified 498 companies from among India’s Top 500 companies who announced their financial results for the first three quarters (June, Sept, and Dec) of FY16 and FY15. These companies were considered for the purpose of analysis.

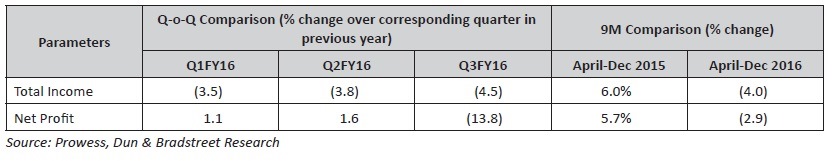

Corporate India displays subdued performance during 9M FY16

Despite the positive domestic economic indicators, factors arising due to volatile external environment seemed to have an adverse impact on the performance of India’s Top 500 companies. The total income of Top 500 companies declined by 4% during 9M FY16 as compared to 9M FY15, while their PAT declined by 2.9% during the same period.

Earnings Scorecard

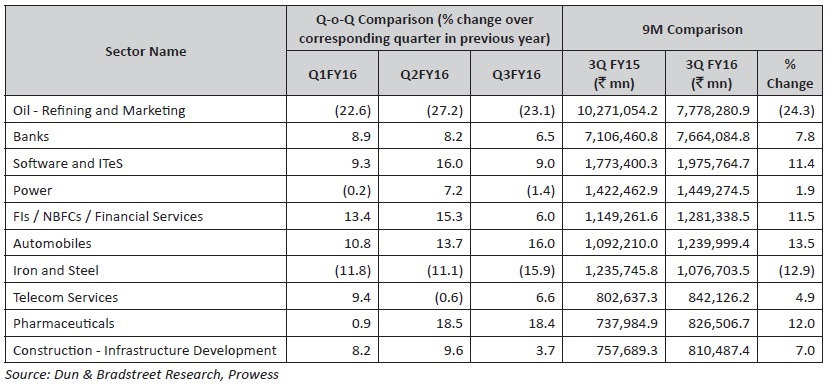

Of the top 10 sectors with maximum contribution to the total income of Top 500 companies during 3Q FY16, four sectors namely Oil – Refining & Marketing and Iron & Steel witnessed a decline in their total income growth during 3Q FY16 as compared to 3Q FY15.

Income-wise Top 10 contributing sectors (3Q FY16)

The total income of Top 500 companies in the Oil – Refining & Marketing declined by 24.3% in 3Q FY16 over 3Q FY15. This was mainly due to the decline in international oil prices which had a direct impact on the earnings of the Oil – Refining & Marketing companies in India. The total income of the Top 500 companies in the Iron & Steel sector declined by nearly 13% in 3Q FY16 which was mainly triggered by import of cheap Chinese steel, global slump in steel demand and excess manufacturing capacity.

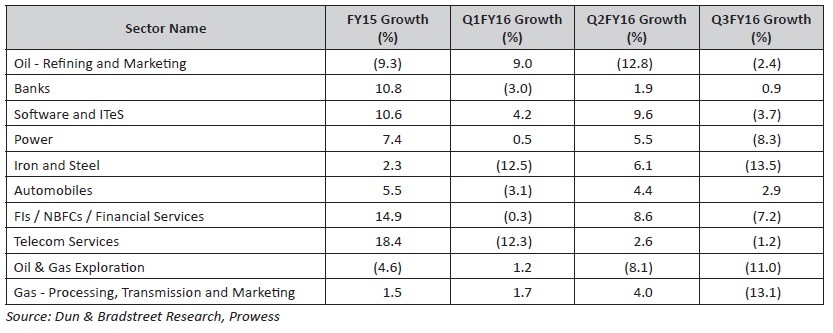

It would be noteworthy to know that of the top 10 sectors, which have highest contribution to the total income of Top 500 companies, eight sectors witnessed a decline in their total income growth during Dec quarter of FY16. Further, total income growth of all the 10 sectors in the first three quarters of FY16 witnessed a decline as compared to the total income growth in FY15.

Comparison of FY15 total income growth vis-à-vis FY16 Quarter-on-Quarter total income growth

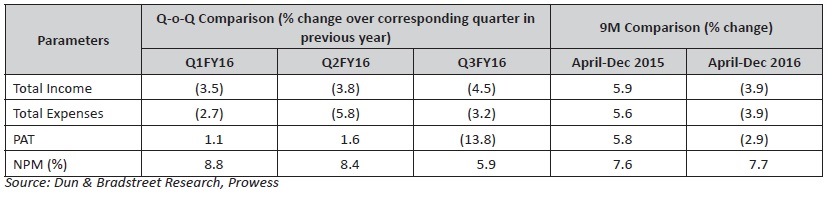

Despite the decline in profits, moderation in commodity prices buoys the profitability of the Top 500 companies

The total income of Top 500 companies declined by 4% during 9M FY16 as compared to 9M FY15, while their PAT declined by 2.9% during the same period. Despite the decline in profits, the Top 500 companies were able to report improved profitability on the back of softening of crude oil and commodity prices, which in turn reduced the total expenses of the Top 500 companies. The total expenses of the Top 500 companies declined by 3.9% during 9M FY16 as compared to 9M FY15 during which they grew by 5.6%.

Quarter-on-Quarter Comparison of profitability of Top 500 companies

A number of geo-political factors were responsible for softening in commodity prices, which further translated into the drop of crude oil price from $55 per barrel to almost $37 per barrel during CY2015. Further, the iron ore prices reduced from $67 per metric ton to less than $40 per metric ton during CY2015, mainly due to oversupply of ore from Chinese market. All these factors coupled with geo-political influences led to the decrease in raw material cost thereby reducing the overall expenses of Top 500 companies, thereby cushioning the profitability of the Top 500 companies.