D&B Direct for Finance Features

Financial Insights

Reduce credit risk, identify hidden opportunities, and in turn improve your cash flow with insights on the financial performance of a company

Automated Decision-making

Automated decision making by using company financial data statements to help you manage receivables, risk and collection priorities

Better Financial Decisions

Faster and better finance decisions with synchronized flow of information across systems

Streamlined Processes

Faster due diligence with streamlined processes for new deals and acquisitions

Better Opportunities

Transform finance from “sales inhibitor” to “sales enabler” with a shared view of risk and opportunity

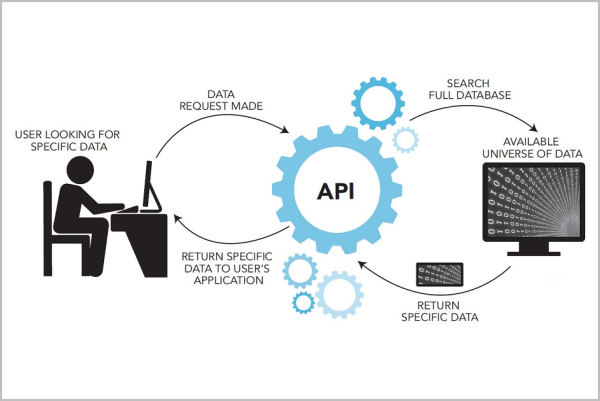

Seamless Integration

Availability of all financial data within ERP and accounting applications